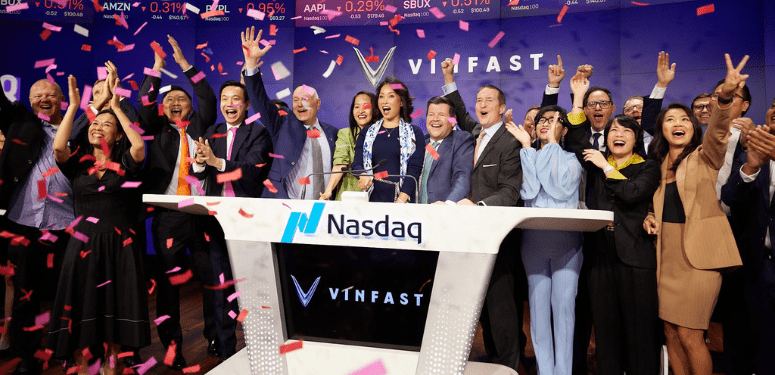

New York, United States — Vietnamese electric vehicle manufacturer VinFast went public on the Nasdaq last week, with a whopping US$85 billion valuation—almost twice that of General Motors or Ford, the two largest automakers in the U.S.

VinFast, listed as ‘VFS’, opened its shares at US$22 each last Tuesday and closed the day at US$37.06 per share, marking a 68 percent gain.

VinFast secured a Nasdaq listing thanks to its merger with special purpose acquisition company (SPAC) Black Spade Acquisition. The deal valued VinFast at approximately $23 billion, according to a filing with the U.S. Securities and Exchange Commission from June.

As of Wednesday’s close, shares of VinFast sat at US$37.03 per share, up 140 percent from its Aug. 18 Nasdaq debut.

VinFast delivered its first vehicles to Canada in May, where a shipment of 781 EVs sailed in to a Nanaimo, B.C. port.