Toronto, Ontario — This week’s Tuesday Ticker covers VinFast’s valuation increase and Rivian’s decision to up production guidances for 2023.

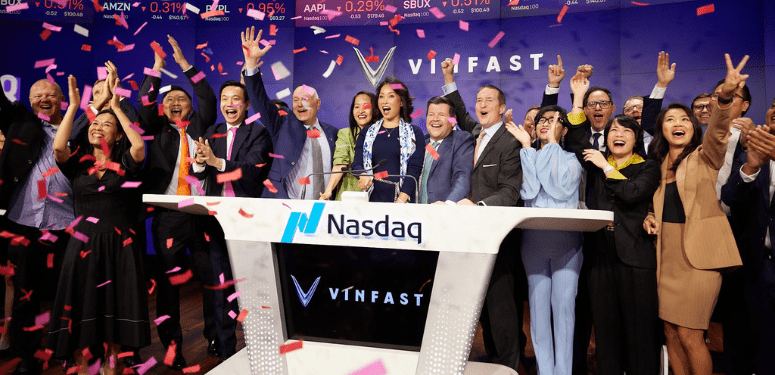

Viva la VinFast

VinFast went public on the Nasdaq last week, with a whopping US$85 billion valuation—almost twice that of General Motors or Ford, the two largest automakers in the U.S.

The Vietnamese EV maker opened its shares at US$22 each last Tuesday and closed the day at US$37.06 per share, marking a 68 percent gain.

VinFast secured a Nasdaq listing thanks to its merger with special purpose acquisition company (SPAC) Black Spade Acquisition. The deal valued VinFast at approximately $23 billion, according to a filing with the U.S. Securities and Exchange Commission from June.

As of Monday at 11:20 a.m. ET, shares of VinFast trade at US$17.01 per share.

Rivian raises forecasts

Rivian increased its full-year production forecast earlier this month. The electric vehicle maker now predicts it will produce 52,000 units this year, up from the previous estimate of 50,000.

The automaker topped Wall Street estimates for Q2 2023. It also delivered 12,640 vehicles between April and June, beating analyst estimates of 11,000.

CEO R.J. Scaringe says the EV maker has a cash balance that takes Rivian “through 2025.”

“We will be very thoughtful and intentional on how we secure additional capital to support the growth of the R2 program,” he added, referring to the automaker’s incoming line of smaller, cheaper vehicles.

The post Tuesday Ticker: VinFast’s massive valuation; Rivian raises production forecast appeared first on Collision Repair Magazine.